If you need help reining in your

spending and getting your personal finances under control, a budgeting and

finance planning app may be just what you need to get on track. There are so

many personal finance apps to choose from these days. New money management and

budgeting apps pop up every few weeks it seems, so weeding out the poorly built

ones and focusing on the best budget apps can be tough. That’s why you have

Tehnico, where we test and discover great apps for you. In this case, we found

a great and helpful personal budgeting and finance planning app in the name of

WeVest.

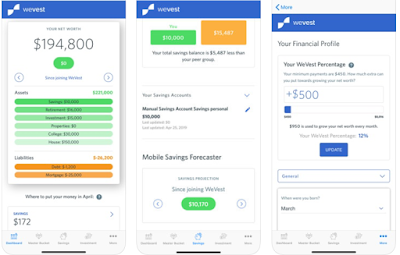

Financial planning with actionable insights

At its core, WeVest Financial Planning is a personal finance planning tool which requires

data about your finances and then gives actionable insights about your finances

future. This secure app uses your data and a complex algorithm to determine

actionable insights that help you meet your goals and optimize your networth.

What data is needed

Once you sign up via your email, you’ll need to give data about

your savings, retirement accounts, investment accounts, college savings for

your kids if any, estimated tax rate, minimum payments, specific saving goals,

income of investment process and similar data.

What will you get

After you enter your data WeVest will analyze it and give

you data about your net worth, set saving goals for different aspects of your

life like retirement and college savings for your kids, emergency savings etc,

plan for retirement, optimize net worth, track and forecast your progress for

each of your accounts and loans, and more.

At the end, this is a really powerful, versatile and

detailed financial planning tool that can be of great help if you want to get

control and improve your personal finances. Try it for free – it’s cross

platform.

App Store Download

Link (iOS): WeVest

Financial Planning

Google Play Download

Link (Android): WeVest

Financial Planning

Website: WeVest Financial Planning